MFI NGOs back Sen. Bam’s candidacy for his work in strengthening sector

An overwhelming number of microfinance non-government organizations (MFI NGOs) want re-electionist Sen. Bam Aquino back in the Senate for his solid track record in helping the sector develop and expand their capacity to extend assistance to more Filipinos.

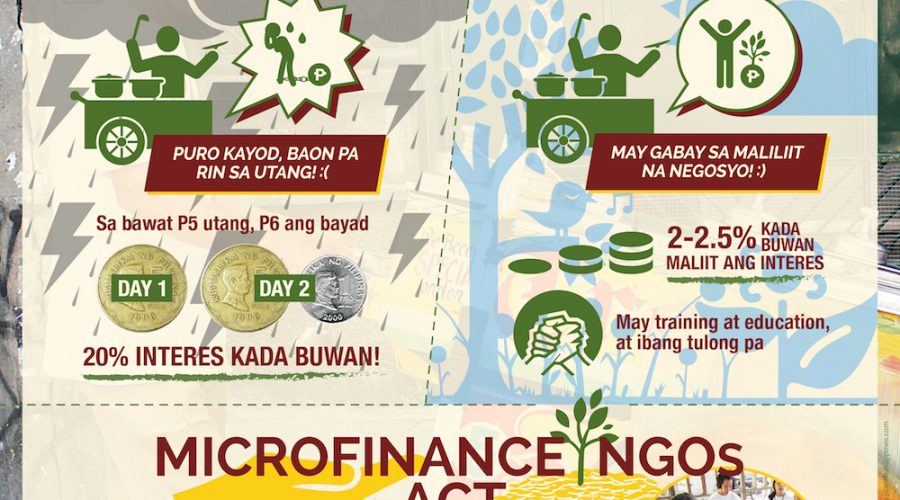

SEDP-Simbag sa Pag-asenso, Inc., led by its president and CEO Fr. Jovic Lobrigo, was among the first to express support behind Sen. Bam, saying he was instrumental in passing Republic Act 10693 or the Microfinance NGOs Act benefiting millions of women and their families.

“Praying that he can continue his work in the Senate,” the group said in a statement posted on Facebook.

Eduardo Jimenez, president of Kabalikat para sa Maunlad na Buhay, Inc. (KMBI), promised to definitely vote and campaign for Sen. Bam, who, he said, collaborated and supported microfinance players even before becoming a senator.

Jimenez added that Sen. Bam’s RA 10693 supported and strengthened the work of MFI NGOs that ultimately helped micro-entrepreneurs in the country.

Mercy Abad, president of Ahon sa Hirap, Inc (ASHI), said Sen. Bam has done a lot for the “common tao”, adding that the Microfinance NGOs Act has “helped our sector serve thousands of families.”

“We in the microfinance industry cannot thank him enough for what he has done to assist us in our work,” said Abad, believing that the country needs leaders like Sen. Bam in the Senate.

“Intelligent, with integrity (naku sigurado kayong hindi kurakot), fearless, and hard working for our country, especially for the poor. Please include him in your vote,” added Abad.

Gomby Maramba, manager for Research and Development of the Negros Women for Tomorrow Foundation, also expressed gratitude to Sen. Bam for pushing for the passage of RA No. 10693 as principal sponsor and co-author.

“The impact of this bill is huge for the over seven million microfinance clients and their families in the Philippines,” said Maramba.

“It allowed us to continue with our non-financial services and at the same time, all microfinance NGOs are now regulated to better serve its clients,” he added.

The law sets performance standards and provides preferential tax treatment for MFI NGOs to enable them to continue to operate and serve poor Filipino communities through financing, financial literacy, livelihood, and entrepreneurship training.

Aside from the MFI NGOs Act, Sen. Bam pushed for the passage of other laws for the development of micro, small and medium enterprises, such as the Go Negosyo Act, Youth Entrepreneurship Act, Credit Surety Act and the Personal Property Security Act.

Recent Comments